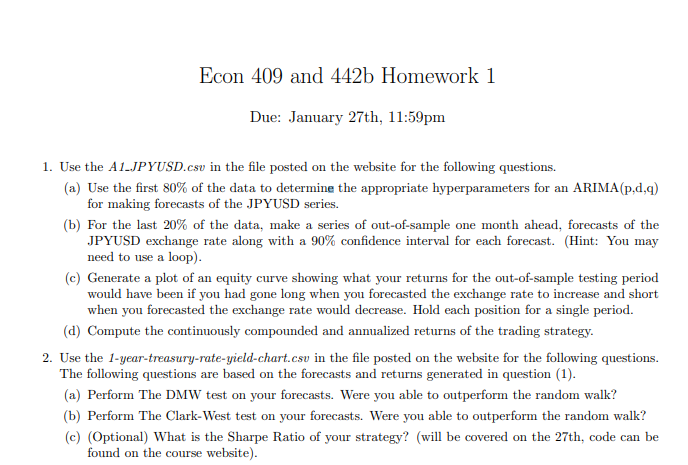

1. Use the A1 JPYUSD.csv in the file posted on the website

for the following questions.

(a) Using the first 80% of the data to determine the

appropriate hyperparameters for an ARIMA(p,d,q) for making forecasts of the

JPYUSD series.

(b) For the last 20%

of the data, make a series of out-of-sample one month ahead, forecasts of the

JPYUSD exchange rate along with a 90% confidence interval for each forecast.

(Hint: You may need to use a loop).

(c) Generate a plot of an equity curve showing what your

returns for the out-of-sample testing period would have been if you had gone

long when you forecasted the exchange rate to increase and short when you

forecasted the exchange rate would decrease. Hold each position for a single

period. (

d) Compute the continuously compounded and annualized

returns of the trading strategy.

2. Use the 1-year-treasury-rate-yield-chart.csv in the file

posted on the website for the following questions. The following questions are

based on the forecasts and returns generated in question (1).

(a) Perform The DMW test on your forecasts. Were you able to

outperform the random walk?

(b) Perform The Clark-West test on your forecasts. Were you

able to outperform the random walk?

(c) (Optional) What is the Sharpe Ratio of your strategy?

(will be covered on the 27th, code can be found on the course website).

No comments:

Post a Comment